Mortgage professor extra payment

When you enter the Actual Payment the extra payment column is calculated for you. Firstly you need the other partys consent.

Let Me Tell You About The Very Rich Wrote Tragic Novelist And Partier Extraordinaire F Scott Fitzgerald They Are Di Student Loan Payment Tax Refund Money

With an income of 54000 per year for example thats a mortgage payment of up to 2250 per month when you might actually only be bringing home just 2900 per month after taxes.

. Who This Calculator is For. To link to our ARM Mortgage. Make sure that your mortgage doesnt charge prepayment penalties before making a lump-sum payment.

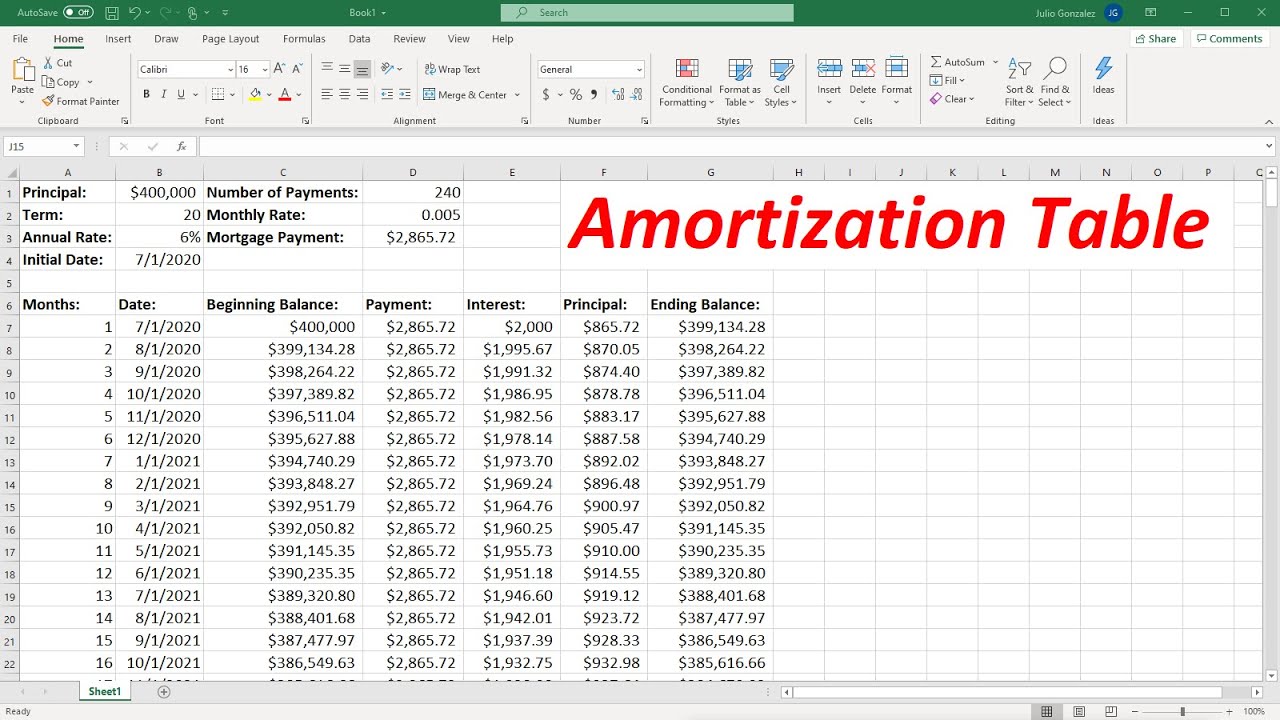

In general buying a vacation property requires a higher down payment and you will be charged a higher mortgage interest rate. Share Our ARM Calculator. An amortization schedule is a complete table of periodic loan payments showing the amount of principal and the amount of interest that comprise each payment until the loan.

There are two ways you can receive help from The Mortgage Professor or one of his counselors. Fannie Mae HomePath mortgage. Borrowers who want an amortization schedule.

FHA loans are designed for low-to. But there are costs involved in breaking any contract. Key loan parameters are principal interest rate periodic payment and duration.

Debt consolidation extra payments prepayment refinancing. Spend that monthly mortgage payment wisely. This is comparable to 13 monthly payments a year which can result in faster payoff and lower overall interest costs.

Households will get an additional amount up to 250 if they have qualifying dependents. Vacation property mortgage interest rates are generally 05 higher as well. Mortgage calculators can also include parameters such as rate of inflation and taxation.

Low down payment no appraisal needed and no PMI January 23 2016 Fannie Maes mandatory waiting period after bankruptcy short sale pre-foreclosure is just 2. With bi-weekly payments you pay half of the monthly mortgage payment every 2 weeks rather than the full balance once a month. Because there are 26 biweekly periods in a year the biweekly produces the equivalent of one extra monthly payment every year.

Rent versus buy decisions are specialized forms of mortgage calculators. She is an adjunct professor at Connecticut State Colleges Universities Maryville University and Indiana Wesleyan University. Mortgage rates pulled back this week but economic uncertainty continues to keep price-struck buyers at bay.

Thats a dangerous place to be because you wont have the cash flow to deal with any emergencies or extra savings. New Zealand law requires banks to allow a mortgage fixed rate contract to be broken. New Loan Amount or Existing Loan Balance eg.

Still if youre wondering exactly where that money should go consider putting some of it back into your house suggests Nancy Butler a Waterford Connecticut-based business coach and motivational speaker who specializes in working with businesses particularly. There are many reasons to want to break a fixed rate mortgage contract. You can request someone to call you or you can send a question and someone will email you the answer.

An FHA loan is a mortgage issued by federally qualified lenders and insured by the Federal Housing Administration FHA. Questions About Monthly Payment Management. I normally see vacation property loan-to-value ratios of 30 and up in order to get a mortgage.

Real estate 40 cities that could be poised for a housing crisis. Questions About Systematic Extra Payment Plans. When you get a mortgage the lender usually adds the property taxes and insurance premiums to the monthly payment setting aside the money in an escrow account to make sure those bills are paid on.

And if they give it they would want any costs they are have covered. Taxpayers with incomes at 75000 or above will receive a phased benefit with a maximum payment of 250. Pensioners to get extra 300 to help with cost of living - when to expect the payment Energy bills calculator.

The actual payment should only be the principalinterest portion the spreadsheet does not track fees or escrow. Homebuyers with a down payment of less than 20 percent are usually required to get private mortgage insurance or PMI. Doretha Clemons PhD MBA PMP has been a corporate IT executive and professor for 34 years.

Down Payment Minium Down Payment 0 VA loans 35 FHA 3 Conventional loans Affordable Loan Solution mortgage Freddie Mac Home Possible mortgage 5 Other loans 0 - 5 Key Features. From the Mortgage Professor. And an extra payment of 400 for months 7-36 you enter 100 for months 1-6 500 for months 7-9 and 400 for months 10-36.

Mortgage Payoff Calculator 2a Extra Monthly Payments. Discover how much youll be pay this winter before price cap rise. This is an added annual cost about 03 percent to 15 percent of your mortgage.

A biweekly mortgage is one on which the borrower makes a payment equal to half the fully amortizing monthly payment every two weeks explains Jack Guttenberg aka.

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Mortgage Payment Calculator Mcap

Spreadsheets The Mortgage Professor

How To Pay Off Your Mortgage In 5 Years Slash Your Mortgage With A Proven System The Banks Don T Want You T Mortgage Tips Mortgage Payoff Mortgage Infographic

Amortization The Mortgage Professor 5 Youtube

January 2019 Budget Toddler On The Tenure Track Student Loan Repayment Paying Student Loans Paying Off Student Loans

Mortgage Amortization How Does It Work The Mortgage Professor

How To Create An Amortization Table In Excel Youtube

Loan Payment Spreadsheet Personal Financial Planning Financial Planning Financial Plan Template

Are Extra Mortgage Payments Better Than Refinancing Mortgage Professor

Realtor New Year Pop By Tag Real Estate Pop By New Year Gift Etsy Real Estate Marketing Gifts Marketing Gift Realtor Marketing Gifts

The Truth Machine The Blockchain And The Future Of Everything Paperback Walmart Com Truth Blockchain Michael J

Should You Make Extra Mortgage Payments Compare Pros Cons

Loan Payment Spreadsheet Personal Financial Planning Financial Planning Financial Plan Template

:max_bytes(150000):strip_icc()/dotdash_Final_Amortized_Loan_Oct_2020-01-3a606fa9285943098248ac92e8d03b40.jpg)

What Is Amortization Schedule

Http Www Mtgprofessor Com A 20 20reverse 20mortgages Which 20reverse 20mortgage 20option 20to 20choose Html Reverse Mortgage Tutorial The Borrowers

How To Calculate Your Monthly Mortgage Payment Given The Principal Interest Rate Loan Period Youtube